marin county property tax calculator

Base fees represent the fee-for-service value adopted by ordinance for each permit type. Also you can visit the Marin Countys Assessor and.

Property Tax By County Property Tax Calculator Rethority

The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate.

. Taxing units include city county governments and various special districts such as public schools. Marin County California Mortgage Calculator. The Marin County Sales Tax is collected by the merchant on all qualifying sales made within Marin.

The supplemental tax bill is in addition to the annual tax bill. Method to calculate Marin City sales tax in 2021. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The median property tax on a 86800000 house is 546840 in Marin County. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes. Marin County collects on average 063 of a propertys assessed fair market value as property tax.

The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. This board is governed by the rules and regulations of the board of equalization and property tax laws of the. The average sales tax rate in California is 8551.

Property Tax Estimator Will you be getting homestead. The calculator will automatically recalculate anytime you press the tab key after making a change to an input field. Marin county california mortgage calculator.

The median property tax on a 15070000 house is 146179 in Florida. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Offered by County of Marin California.

Present this offer when you apply for a mortgage. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate.

Martin County Property Appraiser. This is equal to the median property tax paid as a percentage of the median home value in your county. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. Method to calculate Marin County sales tax in 2021.

YES HomesteadPortability NO Non. Choose RK Mortgage Group for your new mortgage. Marin County California Mortgage Calculator.

Final permit fees are calculated as the sum of the base fees plus impact fees and taxes as well as any additional fees charged by other approval. California Property Tax Calculator. The purpose of this Supplemental Tax Estimator is to assist the taxpayer in planning for hisher supplemental taxes while waiting for their.

The median property tax on a 86800000 house is 642320 in California. 3473 SE Willoughby Blvd Suite 101 Stuart FL 34994 772 288-5608. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Establishing tax levies estimating property worth and then receiving the tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. California Property Tax Calculator.

Method to calculate Marin City sales tax in 2021. Tax Rate Book 2016-2017. Property Tax Bill Information and Due Dates.

The median property tax on a 15070000 house is 158235 in the United States. The median property tax on a 15070000 house is 129602 in Marion County. Secured property tax bills are mailed only once in October.

They all are legal governing units managed by elected or appointed officers. The median property tax on a 15070000 house is 158235 in the United States. The information provided above regarding approximate insurance approximate taxes and the approximate total monthly payment collectively referred to as approximate loan cost illustration are only.

Overall there are three stages to real estate taxation. The median property tax on a 15070000 house is 158235 in the United States. See detailed property tax report for 123 park st marin county ca.

The median property tax on a 86800000 house is 911400 in the United States. For more information please visit California State Board of Equalization webpage or this publication. We take your home value and multiply that by your countys effective property tax rate.

Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes. Penalties apply if the installments are not paid by. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

How was your experience with papergov. The median property tax on a 86800000 house is 546840 in Marin County. Real Property Searches.

Tax Rate Book 2015-2016. Tax Rate Book 2016-2017. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate.

The average sales tax rate in California is 8551. Marin County collects on average 063 of a propertys assessed fair market value as property tax. Tax Rate Book 2013-2014.

Tax Rate Book 2014-2015. Tax Rate Book 2012-2013. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

The Property Tax Inheritance Exclusion

2022 Best Places To Buy A House In Marin County Ca Niche

Santa Clara County Ca Property Tax Calculator Smartasset

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin Wildfire Prevention Authority Measure C Myparceltax

Understanding California S Property Taxes

Property Tax By County Property Tax Calculator Rethority

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

California Mortgage Calculator Smartasset

Property Tax California H R Block

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

Transfer Tax In Marin County California Who Pays What

Property Tax By County Property Tax Calculator Rethority

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

Transfer Tax In Marin County California Who Pays What

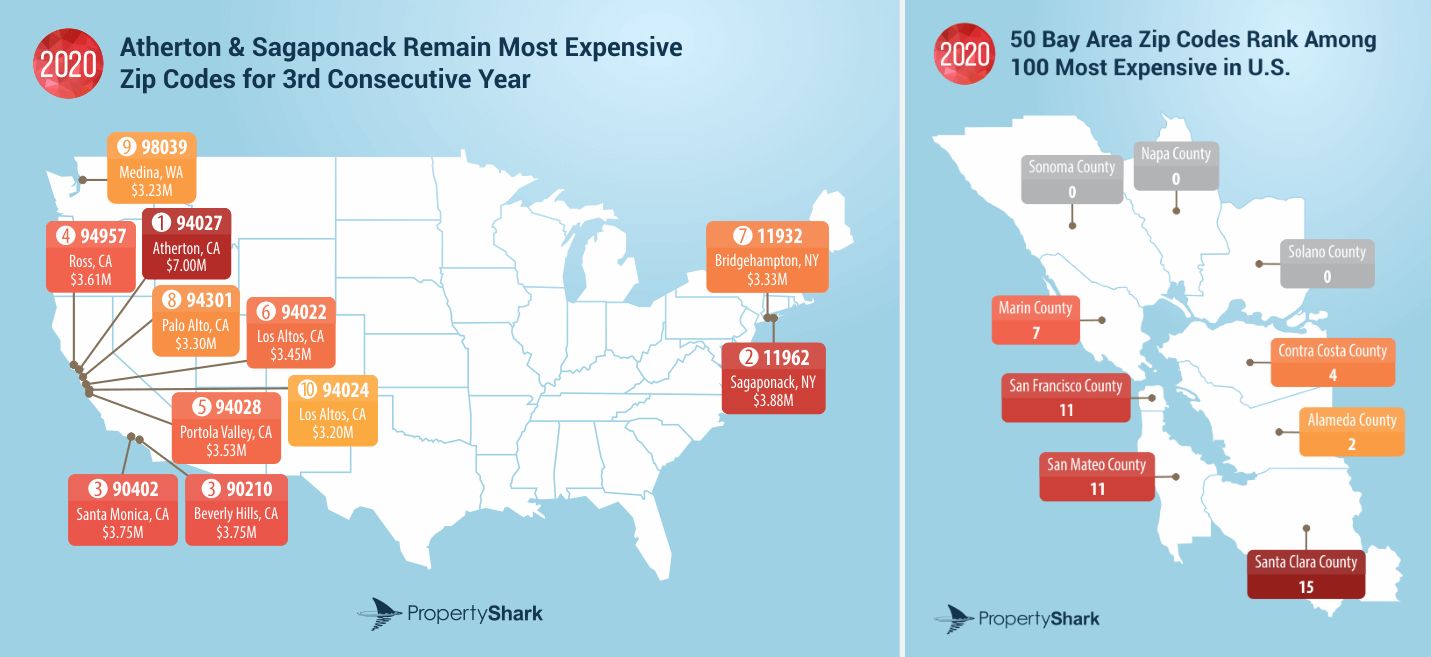

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

Property Tax By County Property Tax Calculator Rethority

Marin County California Property Taxes 2022

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom